Chinese-owned African fintech startup, OPay, has announced the appointment of former FCMB Executive Director for Retail Banking, Olu Akanmu as the new president/Co-CEO for its Nigerian division.

According to the company, Olu Akanmu will work alongside the current leadership team to guide Opay Nigeria towards attaining all of the company’s goals and objectives.

Olu Akanmu, who has a previous background in the banking and telecommunications sectors, brings more than 20 years of corporate leadership to this role.

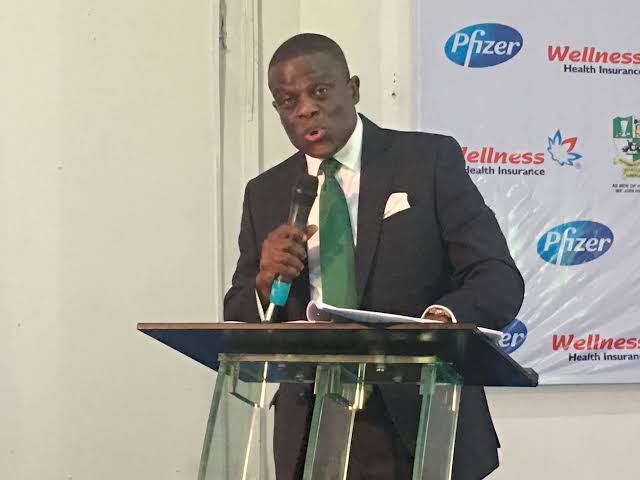

Meet Opay’s new president and co-CEO

Before his appointment as Opay Nigeria president, Olu Akanmu had held the position of Executive Director for Retail Banking at FCMB for more than eight years.

Prior to this role, he had also held the position of senior vice president/Divisional head of retail banking at the same FCMB.

His background in the Nigerian banking sector may provide him with an advantage in leading the fintech firm, but he also has extensive experience in the Nigerian telecommunication services industry.

According to his impressive employment record, he had been the chief marketing officer for Airtel Nigeria, a position he held briefly between 2012 and 2013.

His immersion into this role was just shortly after he moved on from a five-year experience as the managing director for retail and consumer banking at the now-defunct Bank PHB.

He had also, for more than five years, held the position of General Manager for consumer marketing at MTN, shortly after leaving Insights Communication as their client service director.

Olu Akanmu has a rich educational background that spans many years within and beyond the shores of the country. He holds a Bachelor’s Degree in Pharmacy from Obafemi Awolowo University, Ile-Ife. He also bagged an MBA from Lagos State University.

He had also attended the University of Witwatersrand and Edinburgh Business School, where he achieved a distinction in the Management Advancement Program and a post-graduate certificate in Business Research, respectively.

The Nigerian business experience

Olu Akanmu’s appointment as president of Opay Nigeria follows a series of rocky and difficult times that the company has had to face doing business in Nigeria.

OPay launched into the Nigerian market in May 2019. Along with its fintech service, the company also launched a bike-hailing service, ORide. The company would eventually expand its service into various other verticals.

It expanded to include OList (classified ads), OFood (food delivery), OKash (loans), OCar (ride-hailing), OBus (bus-hailing), and OWealth (investments).

However, in July 2020, the company had to shut down some of its business units to focus only on financial technology services.

That was partly due to the spread of the COVID-19 pandemic, as well as the Lagos State Government’s policy prohibiting commercial motorcycles in much of the Lagos metropolitan area.

All of the company’s ride-hailing platforms (ORide and OCar), as well as OExpress, its delivery service, had to be put on hold.

“We can confirm that some of our business units, including the ride-hailing services ORide and OCar, as well as our logistics service OExpress, will be put on pause. This is largely due to the harsh business conditions that have affected many Nigerian companies, including ours, during this COVID-19 pandemic, the lockdown, and the government ban.

Opay

Africa’s Unicorn

The fintech company has since rebounded from its misfortunes, achieving unicorn status in August after raising an impressive $400 million a funding round led by Softbank.

Opay’s current valuation of $2 billion is higher than its predicted valuation of $1.5 billion. The company claims it will continue to focus on assisting emerging nations in their economic development.

“We want to be the power that helps emerging markets achieve faster economic development,” Opay CEO, Yahui Zhou speaking with Bloomberg.

Although competing in the Nigerian market hasn’t been easy, the company has a monthly transaction volume that exceeds $3 billion and boasts of over 300,000 agents and more than 5 million users across Nigeria.