Culled from Nairametrics. First published on Nairametrics in 2018

A story of the battle for Cement dominance in Africa’s largest economy, Nigeria. How one man surmounted rivals, both big and small, to become the undisputed King of African Cement and another battled with the guardians of the corridors of power.On a cold afternoon in November 2005, Federal Government operatives, acting on orders from above, swooped down on a busy factory in the oil rich city of Port Harcourt. They were under instructions to seal off a warehouse whose operations had contravened a government policy – a policy that would later prove decisive in a brutal race for market share in an industry worth over N1 trillion.

At first, the closure appeared to be due to a mix-up between an agency of the Government and the owners of the warehouse. It was expected to be resolved in a matter of days by the billionaire Chairman of the company. Emissaries were dispatched to help resolve whatever misunderstanding may have led to the seemingly excessive act by the government.

As days turned into weeks and weeks into months, it dawned on the owners of the multi-billion-naira conglomerate, which was based in the South-Eastern part of Nigeria, that they were dealing with powers that stretched far beyond the red earth of the South East.

Something had to be done to resolve this issue.

At stake was not only the reputation of the company, but billions of naira in inventory that could erode all the wealth that had been built over the years.

Flashback – School boy

It was January 22, 1966 in the bustling suburb of Nnewi in Anambra state, South-Eastern Nigeria. Nigeria had just witnessed a deadly coup one week earlier, and the mood in the country was still tense. But for a certain household, a major decision had to be made. Cyril, the eldest son of the home, was having a chat with his father that would decide the fate of one of his siblings. Cyril and his younger brother, Louis, were getting ready to go back to school but had to deliver a message to their father from their uncle. As the discussion with their dad ensued, their kid brother, Cletus, packed his bags in preparation to join his elder brothers in school for the first time. At just 13 years of age, he had his eyes set on acquiring a secondary school education.

He had just gotten admission into Crusader Secondary School, Isingwu Amachala in Umuahia. Seeing his older brothers in their school uniforms and school bags always got him excited and he couldn’t believe that the day he had been waiting for was finally here. As his elder brother left, his father called him in to break the good news, or so he thought. His dad, a sturdy Nnewi man, like most at the time, had a different approach to fatherhood.

Back then and perhaps till today, much was expected from sons, just as was the case for their fathers. Responsibility began at an early age and it started by understanding the language of trade – making money. One of the responsibilities of a father was to ensure that his child had a sound education, not just in academics but in learning how to trade. Cyril and Louis had already toed the path of academic education and that was sufficient for the family. Someone had to toe the path of apprenticeship.

And so, his father would tell the young Cletus that his destiny was not to start in the four walls of an educational institution, but in the four walls of his uncle’s workshop. His uncle was a mechanic named Sir Lawrence Amazu. Young Cletus protested, cried and even went on hunger strike, as he could not believe what his father had done to him. Unfortunately, his tears were futile. He soon found himself on his way to Onitsha to begin life as a motor spare parts trader.

Undeterred and hopeful, he arrived at his uncle’s workshop in his school uniform, earning himself the nickname “school boy”. His fellow apprentices laughed at the sight of him; it was unthinkable to them that a young man would even consider choosing the lazy path of academics over the lustrous and respected route of the spare parts trade. Thus, began a new chapter in the life of Cletus Madubugwu “Omekannaya” Ibeto.

War story

For Cletus Ibeto, the journey to success can be seen more as a case of divine providence, than a case of pure hard work. In one of his many close shaves with death, when the young Cletus was drafted to the Civil War as a batsman to a Biafran Army captain, he was sent to buy food by his superior. Upon returning, Cletus found that his fellow soldiers, including the Captain, had been killed in an ambush by enemies.

A few weeks after that encounter, he was again drafted to the battlefront to fight against the merciless and powerful Nigerian soldiers, alongside other brave Biafran soldiers. The sound of rapid gunfire and pounding mortar were not loud enough to drown the death cries of dying infantry men. As Cletus, the soldier lay on the ground with a bullet lodged in his lungs, the choice between life and death became no longer his to decide. He would survive after spending several months in the hospital, with the mark of his bravery firmly lodged in his lungs. The fortuitous streak that marked his existence continued to be his weapon as he rolled into the next chapter of his life, post-Civil War.

Fortitude

It was 1979 and the newly democratically-elected President of Nigeria, Alhaji Shehu Shagari, had just come into power on the back of an anti-corruption crusade. His government was liberal, so some of the hardline policies of the departed military government of Olusegun Obasanjo were abolished. One of the first decisions taken by the Shagari Government was to lift the restriction on imports and exports.

General Obasanjo introduced import licenses as a means of reducing reliance on foreign goods. The eradication of import licenses would be the next major streak of fortuity for Cletus. Not long after the Shagari administration relaxed the restriction on import licenses, it made a drastic U-turn. Oil prices were falling and government revenues had taken a huge dip. In an apparent haste to stem the tide and shore up revenues, the Shagari Government introduced import licenses again.

The decision sent out a wave of confusion and uncertainty, causing importers to take a step back as they pondered what next to do. As most of them waited on the sidelines to comprehend the flip-flop, Cletus took advantage and pumped in N3 million to import spare parts into the country. After the Civil War, he had doubled down on his knowledge of the spare parts trade. His uncle and former mentor, Sir Lawrence Amazu, pivoted into trading spare parts. Back then, Sir Amazu saw the opportunity to carve a niche for himself in a nascent economy that had just birthed its first set of homegrown middle-class workers. Many of them owned cars that needed servicing, repairs, and replacement of parts. From fixing their cars, he had a light bulb moment – he discovered that there was more value in selling the spare parts of the cars than in servicing or repairing them. With this decision, Sir Amazu became a pioneer in a trade that has since become the bread and butter of hundreds of thousands of young unschooled boys from Nnewi, including the young Cletus.

The decision to import spare parts was, as Cletus had become accustomed to, a timely and fortuitous decision. Soon after his goods arrived, the government of Shagari tightened the noose on import licenses, making it nearly impossible for anyone to get any. Historians believe that this was one of the foundations of the massive corruption in the country at the time.

The decision could not have been more delightful for Cletus. He realized that he was suddenly the only one who had stock of spare parts merchandise filled in his warehouse. Cletus quickly jacked up prices by 500%, yet it did not deter the multitude of resellers looking to also profit from the artificial scarcity created by the government of the day.

In a report, Cletus relived gleefully how pivotal that moment was for him. “We were packing money in cartons,” he remarked. Within two days of the arrival of his containers, he had made about “4 million pounds”. A combination of fortuity, government magic and timing had made him an instant millionaire, opening the floodgates for what would become a mega empire at the heart of South-Eastern Nigeria.

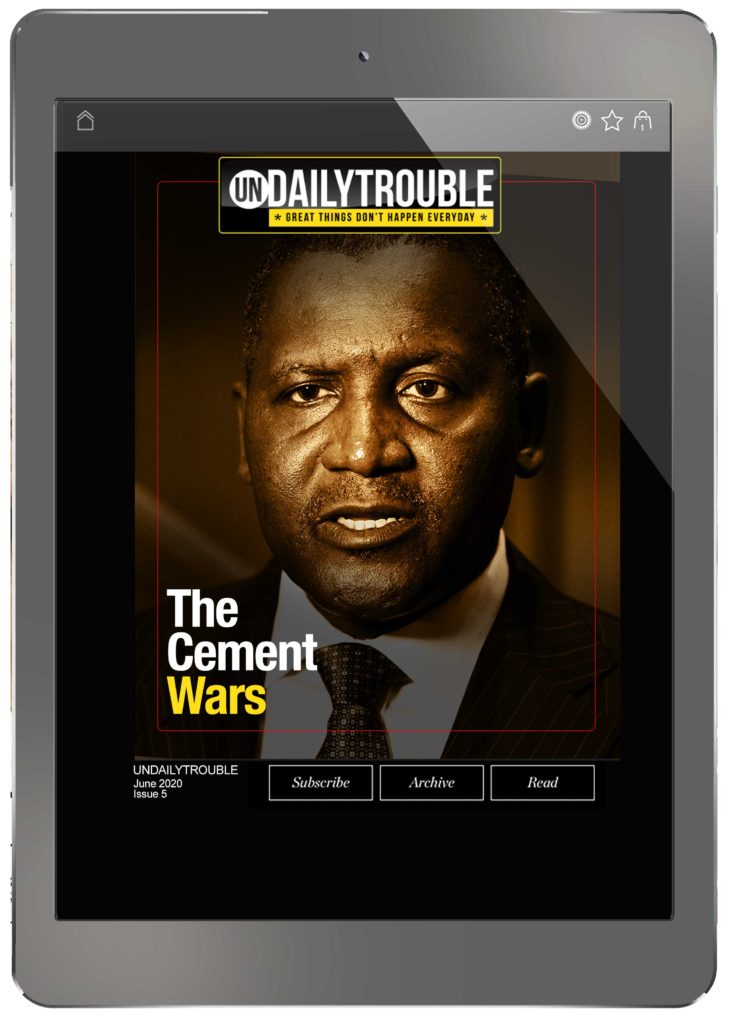

Enter the Challenger

About 800 kilometers away from the burgeoning empire of Cletus Ibeto was a 22-year-old man by the name of Aliko Dangote. Aliko had put to work the N500,000 he received from his uncle as startup capital and was settling into business in his newly adopted trading city of Lagos, South West Nigeria. Little did Dangote and Ibeto know that their paths would cross in a riveting tale of rivalry, reminiscent of that fateful day on the battlegrounds of the Biafra civil war.

In 1997, the already powerful billionaire and president of the sprawling Dangote empire, Alhaji Aliko Dangote, was thinking about pivoting his strategy. In the past 20 years since he moved to Lagos, he had built a reputation as a fierce competitor and a near monopolist in most of the business areas he played in. The young Aliko’s path to riches started with the importation of sugar and rice from Brazil and Thailand respectively. As a young man in the early eighties, Aliko understood the power of monopoly and crony capitalism.

He quickly secured exclusive importation licenses for sugar, rice, and cement, beating out every competition that stood in his way to market dominance. In one unconfirmed story, a rival importer attempted to cut Aliko’s dominance in the sugar market by importing tons of sugar into the country. On getting wind of this imminent threat, a call was made to ranking customs officials, about possible contraband goods making their way into the country. The container of sugar remained stuck at the ports for weeks as demurrage accumulated to the dismay of the bewildered contender.

As he racked up losses, he received a lifeline from none other than Alhaji, offering to buy his product at less than half the price. Such was the palpable fear competitors had of Alhaji, that stories of him stifling rivals out of business became folklore among traders, critics, and admirers alike. Despite the criticism of the young Alhaji, rivals and critics could not but admire his astute craftsmanship and ability to thrive where others had failed. He succeeded where many had failed and ran an empire that dominated the breakfast tables of nearly everyone living in the country.

In one of his trips to Brazil, Aliko was smacked by a sudden reality. Why continue importing products into Nigeria when he could cut out the middlemen and produce same locally in Nigeria? In fact, why not import and manufacture at the same time? The thought of this was exciting and he wondered why he had not done this all along. To enjoy total dominance, he had to own the entire value chain, from production to distribution. This would give him ample powers to control the pricing and dictate supply requirements. It was to be his greatest decision ever.

In the year 2000, Dangote Sugar Refinery commenced business as a subsidiary and sugar division of Dangote Industries Limited. A year later, they commissioned the 600,000 mt-capacity sugar refining facility in Apapa, Lagos. Raw material input from the refinery came from the company’s 200,000-hectare sugar plantation, thereby solidifying his business model of owning the entire value chain.

To support local industries, the newly elected Obasanjo Government, on the advice of his economic team and industrialists like Dangote, introduced protectionist measures that stifled importation. The government introduced high tariffs and gave tax breaks to mega traders investing in local manufacturing. The government did not stop there. Convinced that local manufacturers required a period of tutelage before they could become fully independent producers and meet the demands of consumers, they allowed manufacturers to import the same products that they manufactured. The policy methodically termed backward integration, would become the playbook for Dangote’s next business juggernaut.

Successive Nigerian governments have tried several policy measures over the years in the bid to diversify the economy and enthrone self-sufficiency in the country. In the military era, which lasted between 1983 and 1998, billionaires like Cletus Ibeto and Aliko Dangote enjoyed massive government tax cuts and import waivers that guaranteed monopolies in their respective industries.

But under President Obasanjo’s regime, local business monopolies enjoyed some of the largest import duty waivers ever granted by a government. According to one report, President Obasanjo granted import waivers to about 1,843 beneficiaries in 2007 that cost the government over N165 billion in revenue losses. Critics of the government cited the need to secure re-election contributions from powerful donors from the private sector as motivation for the waivers.

Some of the beneficiaries included powerful private businesses that controlled swathes of the economy. It included the likes of the Redeemed Christian Church of God, Mandarin Hotels, Le Meridien, Federal Palace Hotels, members of the diplomatic corps, companies fronting for top government functionaries, Stallion Group (who used it to import rice), and of course the Dangote Group which, report claimed, got as low as 5% as concession for importing sugar.

In a report in 2011, the Senate had declared that Nigeria lost about “N1.3 trillion to waivers granted on the importation of rice and other agricultural commodities between 2011 and 2014.”

As is typical with successive governments, policy pronouncements are reversed immediately power changes hands. But for some astute businessmen, 8 years is just about enough to set the stage to own one of the most sought-after assets of the Federal Republic of Nigeria.

It was January 1, 1992, the advent of the new republic in a soon to be the democratic republic of Nigeria. The Military President, Ibrahim Babangida, had just concluded the first phase of an election in fulfillment of his plan to hand over power from military to civilian governance. On that day, democratically elected governors were sworn in for an initial period of 4 years.

One of the men sworn in as Executive Governor was Abubakar Audu of Kogi State, a state that had just been created a year earlier. The Prince, as he was often referred to, was renowned for his flamboyant dress sense, charisma, and government-initiated private enterprise. As Governor, one of the first businesses the Prince initiated was the creation of Obajana Cement Plc in 1992.

The Prince believed that the cement plant would launch the newly created state into economic prosperity, creating jobs and increasing alternatively generated revenue. The state did not have the technology or technical know-how to achieve this objective, but with the huge deposit of limestone located in the state, all he needed was to find the right foreign technical partners who would help explore the natural resources which God had endowed the state with. It was a time-tested template and surely it would work, once the state showed enough commitment under his leadership.

Unfortunately, the plan was truncated a year later, as the Military Junta led by Ibrahim Babangida annulled the 1993 Presidential election, sending the country into a political tailspin that would usher in a period of political instability, and eventually lead to a power grab by one of the most ruthless dictators ever to rule Nigeria.

Despite the initial setback, Prince Audu’s two-year stint as Governor had left an indelible mark in the minds of the people of Kogi State and they rewarded this by re-electing him 7 years later in 1999, under a new democratic dispensation led by President Olusegun Obasanjo. In June 2000, one year after being sworn in again, he led a delegation to Israel, France and Germany to source technical experts that would work on the project he had conceived in his first term.

Prince Audu and his team believed that cement deposits found in Obajana could last about 50 years and had the potential to produce over 5,000 metric tons of cement per day if it became operational. They had estimated the cost of the project at about $268 million which would be funded via an equity contribution of both the state government and private sector. Plans to raise debt was also considered as a prerequisite for achieving this objective.

Working with Kogi State Government was Exim Bank in the US and Nov Turkey Cement in Turkey. In fact, following the visit of President Clinton to Nigeria, reports at the time suggested that the United States Government had “released the sum of 750 million dollars to a firm known as Collarado in the US for feasibility studies and exploration of cement deposits at the Obajana Cement Company in Kogi State.”

Elected on the promise to revive the ailing Nigerian manufacturing sector, President Obasanjo had banned the importation of cement but lifted this ban for Obajana to allow it import “BAC Cement to test the market” despite the hesitation of former Finance Minister, Alhaji Adamu Ciroma.

This concession would serve as a template for others looking to delve into the business of cement manufacturing in the country. Two years down the line, politics and mismanagement would slow down the actualization of this dream. By 2003, Prince Audu lost a re-election bid to Alhaji Ibrahim Idris.

As expected, the newly elected governor accused the Prince of massive corruption, paving the way for a trial that would last years. The newly elected government claimed that some of Prince Audu’s policies had cost the state billions in debt.

In one accusation, they claimed that on takeover of office in May 1999, the Abubakar Audu government inherited a foreign debt of $6.34 million. This debt today stands at $341 million, or about N43 billion and a deduction of N50 million is being made from source.

These accusations and counter-accusations stalled most of Audu’s economic initiatives in the state, including the Obajana Cement Company. By the time he left office, the project remained dead, leaving the state with a project that it had no will to pursue. Then came a white knight.

Dangote’s Quest for Cement Dominance

After successfully launching his 600,000 mt-capacity sugar refining facility in Apapa, Aliko Dangote set his sights on something even larger. To achieve the massive economic dominance he wanted, it was important that he identified another commodity that was in heavy demand in Nigeria but with little to no local refining or manufacturing capacity. In continuing with his business model of controlling market share and dictating prices, Aliko Dangote and his team of advisers wanted a product that would, in a sense, dominate every household in the country.

Sugar, rice, and flour were all staple foods and already garnering his rising group a significant market share. However, these products faced massive competition and the barrier to entry was somewhat low when compared to the options at his disposal. He wanted something that could scale, was hard to compete against, and fit the government’s serial rhetoric of self-sufficiency. That option was cement!

Cement business, just like sugar, salt, and flour, was not new to Aliko Dangote and it was something he had been trading in since the early eighties. Back then, the company imported bulk cement into its port terminals in Apapa and Port-Harcourt and then bagged to sell in retail in Nigeria.

It had made an incredible amount of money doing this business throughout the military era and as expected, secured a huge chunk of the market share in addition to several layers of alleged import waivers.

But as the nineties drew to a close, the Dangote Empire decided that it was time to pivot into manufacturing; with the successful launch of Dangote Sugar Refinery, cement was the next big move for the conglomerate and there was no better time than in an era of national optimism under the leadership of pro-nationalist President Olusegun Obasanjo.

Unlike Dangote Sugar, the model for pivoting into cement manufacturing had to be different for Dangote Cement. It required a different form of investment and a legendary battle that would take on an ethnic tone and eventually fought on the pages of newspapers, in communities and villages, and far into the corridors of power. It would eventually be a winner-takes-all battle.

In the year 2000, the newly elected government decided in earnest to continue with the privatization programme laid out by former Military President, Ibrahim Babangida. The privatization programme, which started in several phases, commenced with the sale of government shares in some publicly listed companies and other privately registered entities.

The companies earmarked for sale included National Oil and Chemical Marketing Company Plc (NOLCHEM), African Petroleum Plc (AP) and Unipetrol Nigeria Plc, West African Portland Cement Company Plc (WAPCO), Benue Cement Company Plc (BCC), Ashaka Cement Company Plc (AshakaCem) and Cement Company of Northern Nigeria (CCNN).

It also included 3 banks, namely, FSB International Bank Plc, NAL Merchant Bank Plc and International Merchant Bank Plc. Two of the Cement companies listed for sale, WAPCO and BCC, interested the Dangote Group considerably. At the time, Nigeria had eight cement plants owned by seven cement producing companies. WAPCO, with factories in Ewekoro and Sagamu was, at the time, the largest cement company in the country.

Nigeria was said to also have an estimated total installed capacity of 5 million metric tonnes per annum for the 8 plants, against a demand of about 6 million metric tonnes per annum. However, with challenges from poor power supply, shortages of alternatives such as fuel and diesel and high-interest rates, local production was just 2.5 million metric tonnes per annum.

BCC, Blue Circle Industries, after acquiring government’s stake, owned about 51% of WAPCO, while the O’dua Group was listed as the other significant shareholder of the company. Before the acquisition, BCI owned about 39% of WAPCO.

At the end of the privatization, the Federal Government had sold its 16.5% stake to Nigerians in the capital market, resulting in an ownership of 26.82% for the Odu’a Group, 22% to diverse investors and 51% to Blue Circle.

Another cement company slated for sale was Nigercem, with 40% ownership by the governments of Abia, Anambra, Ebonyi, Enugu and Imo states, and another 11% by the Federal Government. As the eastern states dithered on selling their 40% stake, the FG sold off its stake on the floor of the stock market, leaving the state governors reeling.

With Nigercem and WAPCO gone, Dangote set his sights on the only available cement company yet to be privatized – BCC. The decision to acquire BCC was strategic for Aliko Dangote. The Benue Cement Company was one of 7 indigenous cement companies operating in Nigeria.

The company is located in the Mbayion District of Gboko in Benue State, where an abundance of limestone deposits can be found. In its early days, the company had a production capacity of 900,000MT and sold the popular Lion Brand Portland cement. The strategic location of the plant was such that, the Lion Brand Cement could be sold within the middle belt, Northern and Eastern states of the country.For Dangote, this was critical to his quest to ratchet up market share and secure distribution channels. But acquiring BCC wasn’t going to be easy. It came at a huge cost that turned out to be not just financial but also brought him enemies in a part of the country, who held back their acquiescence with disdain.

It was April 19, 2000, and the National Council on Privatisation (NCP) opened bid for the prospective core investors to show interest in the acquisition of the FG’s stake in Benue Cement Company Plc. Top bidders included Dangote Industries Limited, Blue Circle Industries and Swiss-based Cementia.

Ahead on the list of potential winners of the bid was Cementia, which not only held 4% stake in BCC, but was responsible for the design and construction of the factory. It also managed the plant on behalf of its shareholders. Blue Circle already owned 51% stake in WAPCO and also looked like a formidable suitor for Benue Cement’s ownership.

The third bidder, Dangote Group’s claim was that it owned a 750k metric tonne per annum bagging terminal in Lagos. Without any considerable experience when compared to the other bidders, it seemed that Dangote had no chance of winning. To win this bid, the 43-year-old Aliko Dangote would have to fight his greatest battle yet and gore an ox or two along the way.

The battle for BCC

As the bid opening for the sale of BCC drew closer, the trio of Dangote, Blue Circle, and Cementia sharpened their strategies. For Blue Circle, its experience in running a cement plant was a huge advantage and no one could question its credibility. For Cementia, the 4% stake it had in BCC and its status as operator and builder of the plant put it in a position of strength that the others did not have.

For Aliko Dangote and his group, exploiting the weakness that was inherent in his competitors was going to be his apparent strength. A weakness neither of them knew they had and a strength so potent, it would come to be synonymous with Aliko Dangote for many years to come.

Long before the bid, the contenders took their battle to the media. In a government-sponsored privatization, failure to have a winning media strategy is as bad as not having the money to pay. The stage was first set when then President Olusegun Obasanjo reiterated that, “we will ensure that in every instance, the ownership will not be concentrated in the hands of a few private owners, such that there will be an impression of transferring public companies into private monopolies.”

This statement, as innocuous as it may have seemed at the time, packed a lot of punches. No sooner had it been uttered than we saw the first salvo fired against none other than Blue Circle. In a magazine article about the transaction, Blue Circle was accused of trying to corner the entire cement market, having already owned 80% of the market, in view of its shareholding in Ashaka Cement and WAPCO.

In another article, an anonymous source claimed that Blue Circle was “buying the good cement companies to thereby trap Nigeria so that they can reap monopoly profits.” Another article quoted a PDP stalwart, Alhaji Bala Ka’oje, who chimed in by stating that he thought “it is better for the government to stop the exercise until the Decree is reviewed to ensure a free and fair privatization exercise because the decree as it is now is not explicit.”

The decree he was referring to was the indigenization decree that was promulgated under the leadership of military leader, Olusegun Obasanjo who incidentally was now the democratically elected president. To make matters worse for Blue Circle, rumours started spreading that it would soon be acquired by Lafarge and that it was all a ploy by the French company to corner Nigeria’s cement market.

Only one person stood to benefit from all this – Aliko Dangote. With Vice President Atiku Abubakar and then head of the BPE, Mallam El Rufai on his side, the odds were stacked in favour of Aliko Dangote. But it wasn’t going to be easy. As the media battle ensued, Blue Circle also stepped up its campaign to control the narrative.

Doubts about Dangote Group’s experience as a cement producer started to gather storm in the most unlikely places. A cross section of people from the Mbayion community commenced writing petitions, calling him an economic saboteur. In the petition, they claimed that “the bid by Dangote had ulterior motives and has the effect of finally nailing the coffin of BCC so that Benue State would perpetually lag behind in economic development and therefore conform with their political agenda, which is economic domination.”

A month later, reports emerged that Lafarge had acquired Blue Circle UK and merged with Cementia, thus effectively controlling the African cement market. The media war that started a month earlier, raged on as opinions became divided on whether to sell the company to a multinational or to a Nigerian owned company, whipping up sentiments of nationalism.

Results of the bid indicated that Dangote Group offered N5.30, while Lafarge offered N5.35 per share. Yet, sentiments and political pressure had swayed the bid in the favour of Dangote Group. Blue Circle reportedly pulled out, while Cementia Lafarge “fell out technically” and did not bother to bid again. To the consternation of a lot of people, the Dangote Group eventually paid N918 million to acquire BCC in the summer of 2000. While he won the battle, the outrage that would ensue cast a cloud over the entire transaction.

The host community lashed out furiously, and most indigenes of Benue State believed that they had been shortchanged. The matter generated so much controversy, that the National Assembly had to wade in and conduct a hearing to deliberate on the matter.

One of the most vocal citizens of Benue State against this acquisition was then Minister of Industry, Iyorchia Ayu. In one of the hearings, he accused Vice President Atiku Abubakar of single-handedly giving anticipatory approval to the takeover of BCC by Dangote. According to one account, Ayu claimed that as at July 1999, Dangote had no plans to buy BCC and only declared intent by the end of the year.

He also claimed that Dangote had insisted that he would take over the company “no matter whose ox is gored” and put out an advertorial with the expression, “to support domestic capital and indigenization” of Nigerian companies. Despite all the tirades and community backlash, Dangote had the support of the government of the day who made sure that the acquisition was irreversible. With BCC in the bag, Dangote set his sights on the next-door neighbours.

Capturing Obajana Cement

Two years later in 2002, Dangote Industries Limited invested in the Obajana Cement plant, then owned by the Kogi State Government. Unlike the controversial BCC transaction, the Governor of Kogi State, Prince Audu, was more favourably disposed to the sale and courted Aliko Dangote, who reciprocated in kind.

In a quote attributed to the then 46-year-old billionaire, he expressed his admiration for the governor, who was seeking a reelection at the time. “Under the able leadership of Prince Abubakar Audu, the crown Prince of the Niger, Kogi State is setting the pace in mutual business relationship with us as the local partners in the industrialization of the state in particular and the nation at large.”

With BCC and Obajana fully secured, the Dangote Group went for the next big leverage. The government of Obasanjo granted the group investment incentives to help the group consolidate on its investments.

Minister for Transport, Ojo Madueke, disclosed at the end of a Federal Executive Council meeting that Dangote Industries’ three plants, Ibeshe (Ogun State), Obajana (Kogi State) and Odukpani (Cross River State), would be granted pioneer status in the area of cement production for seven years.

The government also granted the firm 2.5% duty on all plants, machinery and quarry equipment, exemption from payment of the Value Added Tax (VAT) on all plant machinery and quarry equipment, as well as the payment of 5% duties on construction materials not available in the country.

According to a newspaper report, Madueke explained that Dangote Group had requested that it be granted pioneer status for 10 years, exemption from payment of duties on all plants machinery and quarry equipment, exemption from payment of VAT on all plant machinery and quarry equipment, exemption from payment of duties on construction materials not locally available, massive road construction at sites of the plants by the Federal Government, as well as the permission to import five million metric tonnes of bulk cement at a maximum rate of 5%.

In addition, the government introduced a policy that completely banned bagged cement importation and phased out bulk cement importation over a five-year period. With the acquisitions completed and incentives secured, Aliko Dangote was well on the path to being the single largest cement producer in Nigeria.

Having shown Lafarge what he could do with the state on his side, no one could dictate the direction of the market and no company could dare compete with his empire. That was until an unfamiliar foe, in the name of Cletus Ibeto decided that it was time to disrupt the cement market, not by producing but importing cement; a move that not only threatened to crash the price of cement, but precariously threatened the very existence of Dangote Cement as a market leader in cement production in Nigeria.

Ibeto back on track

As Dangote consolidated on the expansion of his production capacity, Cletus Ibeto also stepped up plans of owning the South East area of the cement market. Ibeto had received a “permission” from the government to allow it import “an unlimited quantity of cement” for 10 years which did not require that he back this up with proven investment in local production of cement.

This apparently gave him some advantages over the likes of Lafarge and Dangote. Realizing the imminent threat, Lafarge petitioned the Obasanjo government, which quickly banned the importation of cement by Ibeto Group, ultimately leading to the ill-fated clampdown on its Port Harcourt warehouse in 2005.

Believing this to be a temporary misunderstanding, Ibeto put across calls to people in positions of influence to help overturn the ban. As he worked his contacts, he was duly informed that whilst Lafarge was the primary petitioner, the biggest threat to the opening of the plant was the Dangote Group.

The company had just helped fund President Obasanjo’s reelection bid and was by then, well in bed with powerful government officials in charge of setting economic policies. Ibeto pondered on how he could salvage the situation. At risk was about 180,000 metric tonnes of bulk cement, waiting to be discharged by six vessels. In February 2006, Ibeto wrote a passionate letter to President Obasanjo begging for the President’s “understanding in respect of whatever transgressions I might have been accused of.”

The content of the letter suggested a man that was losing it financially and mentally. In one of the paragraphs he said, “I have no intention to open up an argument on this matter, but only wish to crave your indulgence for a merciful and fatherly intercession, and to pledge that in all my dealings, I shall always remain faithful, and align myself with the hallowed ideals and laudable programmes of your government”.

He went further, “I have with great trepidation and despair, noted the depth of your disenchantment towards me and realize that I can only hope on your renowned Christian magnanimity, that there is space left in your large Christian heart to afford me the mercy I crave and give me the opportunity to prove my good faith towards this government and its programmes.

“I make this solemn promise; that if Your Excellency will revisit the issue and resolve it in a manner that will enable me to avoid utter ruin, I shall employ all that is salvageable from my cement concerns, to focus on the work going on towards the actualization of my planned cement project in Ebonyi State, to ensure that the factory is completed in record time.” Ibeto again sent another letter to the President in March 2006 entitled “Further Appeal for Clemency” pleading that “All the structures and systems the Ibeto Group has laboriously built over the years are rapidly crumbling, and may totally collapse if there is no succor coming to us soon…”

As Ibeto wallowed in despair, Dangote Cement’s business took shape and started to soar. By 2005, the cement business was unbundled from Dangote Industries Limited, keeping it as an entity on its own. Construction of the company’s first cement production plant in Obajana was also underway and progressing positively.

Dangote’s plan for domination in the cement industry was, in hindsight, very well executed. The acquisition of BCC was strategic for Dangote and the media and reputational battle that followed the transaction was worth the sacrifice. By acquiring BCC, the company had a cement plant that was already in operation. This ensured that it could not only generate cash flows to fund working capital requirement, it also had the leeway to import cement in line with the government’s backward integration plan. Obajana on the other hand would be a new cement plant, built with modern infrastructure that enabled cement production at an efficient economy of scale. Same model in Obajana would be replicated in Ibeshe.

While rumours suggested that Dangote could be behind the apparent rejection of all pleas from Ibeto. The billionaire tried as much as he could to stay away from the matter. But it was not until July 2007 that newly elected president, Alhaji Musa Yar’Adua granted Ibeto his wish by reopening the Ibeto Cement Plant in Bundu Ama, Rivers State, allowing him to manufacture and import cement once again.

The closure of the Ibeto factory was a humbling experience for the Nigerian business magnate. As he pondered on what he had just been put through, his mind flashed back to the many battles he had fought and survived. After a Supreme Court Judgement made him lose a bank in the nineties, the billionaire had embraced the humiliation of sitting for WAEC exam at the age of 48 and later bagged a degree in accountancy at the age of 48. He also recalled turning down a huge opportunity to export refined “lead products” to former Iraqi President Saddam Hussein citing ethical considerations as the reason. This decision cost him significant amounts of money that he could have invested in this same Bunda Ama Creek cement bagging factory that had been banned by the Obasanjo Government.

For about two years that his cement bagging plant was shut, the likes of Dangote Group and Lafarge had forged ahead. In that year, Dangote Cement’s Obajana Cement Plant with two production lines and a capacity of 5 million tonnes per annum was commissioned. Lafarge had merged with Cementia and acquired Blue Circle to become Africa’s dominant cement manufacturer. For Ibeto, it would be about setting the restart button for a business he always thought was the most lucrative anywhere. He once remarked, “Cement is one of the best businesses in the world….it is better than crude oil.” Ironically, his return to the market was positively received by his competitors (at least in the media).

To compensate Ibeto for the two years’ loss of business, the government of Musa Yaradua granted his own tax breaks. Ibeto Group was granted a 5% duty waiver and allowed to import cement “VAT free as compensation.” One columnist reported that the move gave Ibeto Cement a cost reduction of about 12.5%, compared to what other importers were getting. Ibeto was also accused of selling cement to distributors at a price inclusive of VAT; Ibeto denied it.

On the 19th of September, 2007, Ibeto opened the Ibeto Cement Factory in Port Harcourt, Rivers State, taking delivery of about 35,000 metric tonnes of bulk cement from Indonesia, which was the equivalent of about 1,750 bags of Cement. He imported raw cement and then bagged it for resale, not to be considered as manufacturing of cement. Ibeto also promised to do whatever it took to bring the price of cement down and promised not to “allow the monopolistic gangs take over.”

He also boisterously told reporters that cement should sell for N1,250 per bag and predicted a crash in the price of cement in the future. Despite all the rhetoric, Ibeto Cement still did not locally manufacture cement and cement prices never came down. By December, the price of Cement had risen to N1,850 per bag, in what many blamed on Government’s failure to renew import licenses.

This built up pressure on the Minister of Commerce and Industry at the time, Charles Ugwu, to reverse the controversial ban on importation of cement. Those against lifting the ban believed that local manufacturers needed time to attain a production capacity that would surpass local demand and therefore crash prices. In the interim, Nigerians had to pay the ultimate sacrifice by paying higher for cement. The Government granted tax breaks, allowing local manufacturers to build enough capital to fund capacity expansion.

Official estimates in 2007 placed Nigeria’s annual demand for cement at about 17 million metric tonnes, as against local manufacturing capacity of about 8.46 metric tonnes. Local manufacturers only accounted for about 43% of total supply, while imports made up the balance.

The implication was that, so long as local demand outstripped supply, cement prices would remain high. But with the government determined to grow local production capacity, local manufacturers of cement like Dangote and Lafarge had enough incentive to continue to invest in capacity expansion, even if it meant that Nigerians paid a premium for this sacrifice.

Ibeto knew he still could not be referred to as a manufacturer of cement and had to do something about it. In October 2007, he announced that he would be commencing cement production from limestone in Ebonyi State. However, the Bundu Ama factory would grow to have a Flat-storage capacity of 50,000 metric tons and a production capacity of 1,500,000 tons per annum, producing about 6,000 metric tons per day.

It also boasted of two (2) production lines with a total production capacity of 5400 of 50kg bags per hour. Having lost out on some of the existing cement plants in the country, Ibeto turned his sights to the South East where he had a foothold. Just like Dangote, he zeroed in on a troubled moribund cement manufacturing plant which had been privatised by the Government in 2001.

Eastern Bulk Company won the bid as core investor in Nigercem, owners of Nkalagu Cement plant, Nigeria’s oldest cement plant located in Ebonyi State. Nigercem was once a bastion of Eastern industrialization. Upon its acquisition, Eastern Bulk Company held on to 60% of the stock, while Ebonyi State Govt owned 10%. The rest was owned by Nicon and the public. Unfortunately, for over a decade, the promise of bringing back the glory days of cement production in the South East did not materialize from the privatization. The plant remained comatose and rather than create jobs for the people of Ebonyi State, more jobs were lost.

This situation made the plant an obvious target for Cletus Ibeto and so in 2011, he acquired Eastern Bulk Cement Company. Unfortunately, the same fate that befell Aliko Dangote’s acquisition of BCC, in a way affected Cletus Ibeto’s acquisition. In the case of Ibeto, he garnered the support of the community, while the state government, led by Martin Elechi, was fiercely against the acquisition. The Ebonyi State Government believed that the company had shown over the years that it was incapable of turning around the historical cement plant; thus, it moved to revoke the acquisition of Eastern Bulk by the Ibeto Group.

This was 2014 and Martins Elechi was taking on a different Cletus Ibeto. Having fought so many battles and survived scathed and unscathed, he had learnt too much to be pushed over. He knew that to remain an importer of cement, he had to own a cement manufacturing plant. By acquiring Eastern Bulk, no one, not even a state governor would stop him. He went into overdrive. He started by using the power of the media to force the narrative against the embattled Ebonyi State Governor.

Ibeto also cornered leaders of the host communities in Nkalagu to his side. Elechi fought back hard and soon dethroned the three traditional rulers of Nkalagu community. Elechi also revoked the Certificate of Occupancy of the land upon which Nigercem was operating.

Aides of the governor remarked, “As we warn the Ibeto Group and its internal collaborators against their continued efforts to compromise and misinform innocent villagers on the true state of affairs in Nigercem, we assure the people of Ebonyi State that under his watch, Governor Martin Elechi will never enter into any arrangement or make any deal with any individual or group which will mortgage the present or future economic interest of Ebonyi people.” Ibeto heard the comment and laughed hard, the governor did not know what was coming his way.

In the summer of 2014, Martins Elechi was engrossed in a string of impeachment proceedings in the State House of Assembly that threatened his succession plans. His advisers informed him that Cletus Ibeto sponsored the legislators who wanted to impeach him. Ibeto, of course, denied it remarking that “I remain a businessman; that man should stop being afraid of his shadows.”

The infighting in Ebonyi State continued as Governor Martins Elechi supported his Minister of Health, Onyebuchi Chukwu, to succeed him as governor. His deputy, David Umahi, felt aggrieved alleging that his boss had reneged on a pact to support him as the next governor. Between 2014 and the end of Elechi’s tenure in 2015, he ended up facing one political battle after another. In one of the most infamous standoffs, arson was committed at the state house of assembly and the governor barely survived an impeachment notice.

Eventually, David Umahi won the primaries and was elected governor of Ebonyi State. The new governor unsurprisingly favoured Ibeto’s ownership of Eastern Bulk Company and chided his predecessor for stalling the acquisition. “I advised him on the case of NigerCem and the clergymen also did. By now, Ibeto would have revived the company but he refused.” Umahi remarked. As Ibeto and Umahi rekindled their love and triumph, Martins Elechi faced EFCC quizzes and also had his 8 year tenure as governor probed by his successor. The probe still continues today.

Cement Power

As history has taught us, the cement industry’s relationship with crony capitalism is alive and entrenched. The role of the Federal and State governments cannot be overemphasized. For Ibeto and Dangote, the path to ownership was similar in many ways, even as both continually blamed each other for their successes and downfalls. In the case of Ibeto, the setback between 2005 and 2007 was costly, though he has tried to recover through the acquisition of Nigercem and the operations of his cement plant in Rivers State.

For the people of Benue State, their ownership of BCC dwindled from 29% to under 5% by 2009 a year before the merger. By 2014, their ownership stake had dropped to zero. The Governor of Benue State, Gabriel Suswam had presided over the sale of about 43 million units for a total purchase consideration of about N9.6 billion. In a twisted irony, some of the people of Benue State who had once resisted the acquisition of BCC by Dangote, vehemently criticized the sale.

Just like in the case of Ebonyi, the successor of Suswan, Dr Samuel Ortom commenced probe of the sale but to no avail. Indeed, George Akume, another Governor had halted the court process and probe into Dangote’s acquisition of BCC years earlier. But for Aliko Dangote, he would only soar to higher heights. In July of 2010, he changed the name of Obajana Cement to Dangote Cement.

Two months later, he oversaw a scheme of merger between Dangote Cement and Benue Cement and in October of the same year, listed Dangote Cement on the Nigerian Stock Exchange. In 2012, he opened the Ibeshe plant in Ogun State with 6 million metric tonnes capacity. That same year, Obajana increased its capacity by 5 million metric tonnes. By 2014, Dangote Cement had expanded into other countries.

In 2010, Forbes ranked Aliko Dangote as the 463rd richest man in the world, estimating his net worth at $2.1 billion. A year later, he was named the richest man in Africa with an estimated net worth of over $10 billion. By 2018, Dangote Cement revenues had grown from about N61.9 billion in 2008 to over N800 billion in 2018. Within 18 years of the acquisition of BCC, the cement company has grown to be largest in Africa, with a market value in excess of N3.6 trillion.

Because of this incredible feat, the Dangote Group is seen by many as one of the most revered companies in Nigeria. Critics blame the roles of successive governments for its commanding market share. On the other hand, some cite the rising price of cement, juxtaposed with the incredible profit margins posted by Dangote Cement as proof that Nigerians are being shortchanged.

In 2017, its earnings before interest, tax depreciation, and amortization (EBITDA) margin was up 51% to a N388 billion at a 48% margin. Earnings per share is up 33% and dividend up 24%. Dangote Cement had also ramped up its capacity to about 29Mta in Nigeria, over 65% of market share and 46Mta across Africa. Obajana’s capacity will rise to 13.25Mta, Ibeshe 12Mta and BCC, the plant that started it all, with 4Mta. Dangote Cement is also present in several African countries spreading beyond the reddish sands of Mbayion.

Never did a 43-year-old Dangote believe that 18 years later he would be this rich, He still owns almost 90% of the company which is expanding into several countries within sub-Saharan Africa, perhaps replicating the same model that had worked so well in Nigeria. For Cletus Ibeto, even though he publicly remarked that he had “forgiven and forgotten” he will forever silently blame Obasanjo as the man who nearly killed his dreams.

The closure of his cement plant caused him billions of naira in lost revenue and value and cost him a significant portion of the local cement market share. However, Ibeto has fought too many battles not to know that you only live to fight another day. With the successful takeover of Nigercem, he can start to rebuild and expand eastwards. On his side are some American investors who recently declared an interest in acquiring a stake in Nigercem

It is a familiar playbook used by his fiercest competitors: get a technical partner, raise foreign funds, get state and federal government support and concessions, commence production and corner a portion of the market. The cement market is different from what it was 10 years ago and Ibeto knows that there is little to zero chance that he will control market share.

Aliko Dangote has demonstrated what can be achieved when you have guts and government by your side. Ibeto had all the guts any businessman could ever wish for but now, he knows that in the cement market, there is no glory without government.