Fidelity Bank Plc, Nigeria’s top lender has maintained a positive growth trajectory in the first quarter of 2020. This comes as the bank prepares to host its 32nd Annual General Meeting, AGM where it will delight its shareholders, paying out a 20kobo dividend on every share held.

__________________________

In a statement from its investor Relations Unit, the bank continues its unbroken track record as top Tier 2 bank despite COVID -19 headwinds. Fidelity bank’s Unaudited Results, for the 3 months ended 31 March 2020 is a testimony to the excellent leadership of its management and board.

According to Nnamdi Okonkwo, MD/CEO of Fidelity Bank Plc, “Our results for the quarter showed the resilience of our business model in an increasingly challenging operating environment. We have continued to show growth in key performance indices while increasing our cost of risk as we anticipate a tougher business environment.”

__________________________

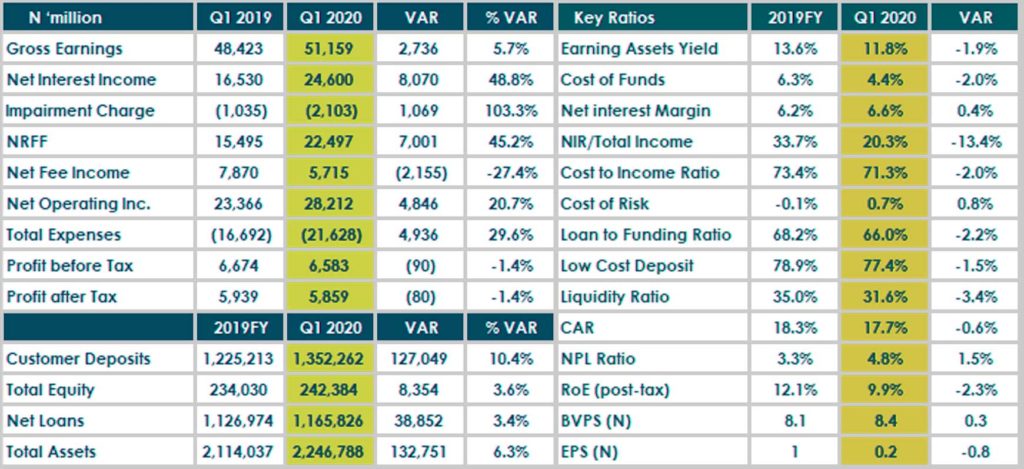

Financial Highlights

Gross Earnings increased by 5.7% to N51.2bn from N48.4bn in Q1 2019

Net Interest Income increased by 48.8% to N24.6bn from N16.52bn in Q1 2019

Net Operating Income increased by 20.7% to N28.2bn from N23.4bn in Q1 2019

Total Expenses increased by 29.6% to N21.6bn from N16.7bn in Q1 2019

Impairment charge increased by 103.3% to N2.1bn from N1.0bn in Q1 2019

Profit before Tax dropped by 1.4% to N6.6bn from N6.7bn in Q1 2019

Net Loans increased by 3.4% to N1,165.8bn from N1,127.0bn in 2019FY

Total Deposits increased by 10.4% to N1,352.3bn from N1,225.2bn in 2019FY

Total Equity increased by 3.6% to N242.4bn from N234.0bn in 2019FY

Total Assets increased by 6.3% to N2,246.8bn from N2,114.0bn in 2019FY

__________________________

Gross Earnings increased by 5.7% to N51.2bn driven largely by a 13.9% growth in interest income on loans and a 5.0% increase in interest income on liquid assets which resulted in N4.5bn growth in total interest income to N43.9bn.

Digital Banking continued to gain traction as we now have 50% of our customers enrolled on the mobile/internet banking products from 47.4% in 2019FY, 83% of total transactions now done on digital platforms and 28.6% of fee-based income now coming from digital banking. However, digital banking income for the quarter dropped by 24.6% due to the downward fee revisions for electronic transactions in line with the new bankers’ tariff.

Net Interest Margin improved further to 6.6% from 6.2% in 2019FY as the drop in our average funding cost outpaced the compression in our average yields on earning assets. Average funding cost dropped to 4.4% from 6.3% in 2019FY resulting in a 15.6% (N3.6bn) decline in total interest expense which translated to a 48.8% increase in net interest income to N24.6bn from N16.5bn in Q1 2019.

Operating Expenses increased by 29.6% to N21.6bn driven by the following cost lines NDIC, AMCON, Advert, Security, Staff which accounted for over 84.5% of the cost growth in Q1 2020. However, operating expenses declined by 10.3% QoQ compared to Q4 2019 which resulted in an improved cost-to-income ratio of 71.3% in Q1 2020 from 73.4% in 2019FY.

Total Deposits increased by 10.4% to N1,352.3bn from N1,225.2bn in 2019FY as we recorded strong growth across all deposit products which reduced our funding costs by 200bps. Local currency deposits increased by 10.1% toN1,031.4bn while foreign currency deposits increased by 11.2% to N320.8bn.

__________________________

Retail Banking continued to deliver impressive results as savings deposits increased by 13.4% to N312.1bn and we are on course to achieving the 7th consecutive year of double-digit savings growth. Savings deposits now account for 23.1% of total deposits compared to 22.5% in 2019FY.

Net Risk Assets increased by 3.4% to N1,165.8bn from N1,127.0bn in the 2019FY. However, the actual growth in risk assets was 0.9% while the impact of the currency adjustment (Dec 2019: N364.7/$ – Mar 2020: N386.5/$) accounted for a 2.5% growth in the loan book. Cost of Risk increased to 0.7% based on increased provisioning in select sectors which resulted in an additional N1.1bn impairment charge to N2.1bn from N1.0bn in Q1 2019.

Non-Performing Loans (NPL) ratio increased to 4.8% from 3.3% in 2019FY reflecting our early conservative assessment of sectors that will be affected by the Covid-19 pandemic.

Regulatory Ratios stood above the required thresholds with Capital Adequacy Ratio (CAR) at 17.7% and Liquidity Ratio at 31.6%.

Going further, Okonkwo states, “We have activated our business continuity procedures in response to the Covid-19 pandemic with over 80% of staff working remotely and customers largely transacting using our digital banking channels. The business environment remains challenging due to the decline in economic activities and the attendant risks on various business sectors. We will continue to monitor and pro-actively manage the evolving risks, sustain our business continuity plan whilst ensuring the safety of our staff and customers.”

ANALYSTS AND INVESTORS CONFERENCE CALL INVITATION

Fidelity Bank Management will hold a conference call on Monday, 04 May 2020 at 15.00 hours Lagos | 15:00 London | 10:00 New York | 16.00 Johannesburg to discuss the Q1 2020 Results. There will be a question and answer session after the presentation of the Q1 2020 performance of the Bank by the management team.

Attendance by shareholders shall be by proxy in compliance with the Corporate Affairs Commission (CAC) issued Guidelines on holding AGMs within the period, on account of the lockdown and the restriction of movement in restricted States.

Attendance is restricted in line with social distancing and other COVID-19 preventive and precautionary measures. You can be part of the AGM by joining the Fidelity Bank AGM by joining online. Livestream starts at 10.00 am.

YouTube –https://youtu.be/_nWFsHBi3hw