-

Global economy’s worst woes since the 1930s

Culled from Financial Times

By Chris Giles. London

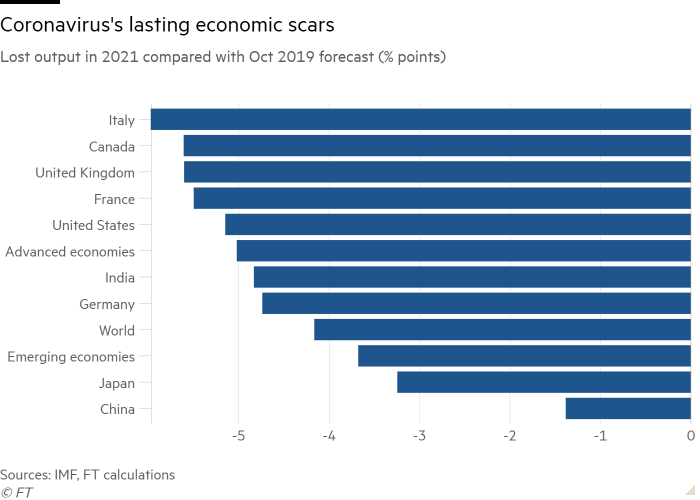

The coronavirus crisis will leave lasting scars on the global economy and most countries should expect their economies to be 5 per cent smaller than planned even after a sharp recovery in 2021, the IMF said on Tuesday.

Forecasting that this year would be the worst global economic contraction since the Great Depression of the 1930s, Gita Gopinath, the fund’s chief economist, said the world outlook had “changed dramatically” since January with output losses that would “dwarf” the global financial crisis 12 years ago.

“A partial recovery is projected for 2021, with above-trend growth rates, but the level of GDP will remain below the pre-virus trend, with considerable uncertainty about the strength of the rebound,” she said.

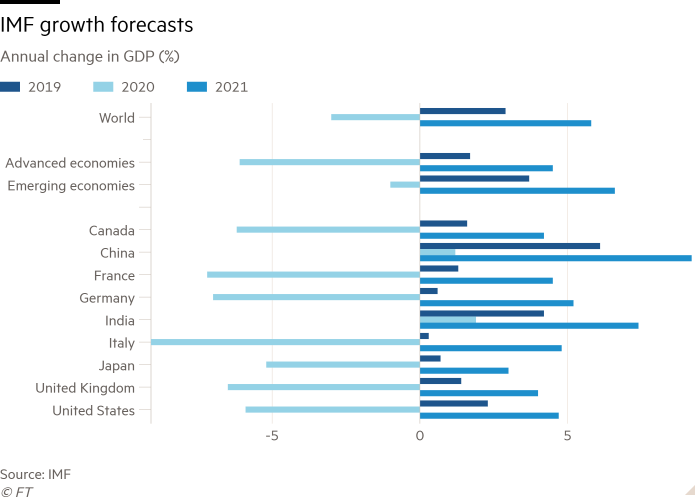

The IMF expects advanced economies to contract by 6.1 per cent and emerging economies to shrink by 1 per cent this year, although positive growth is still expected in India and China. But even after the sharp rebound which the IMF forecasts for next year, output is still expected to be 5 per cent lower in 2021 than expected in the IMF’s forecasts from October last year for advanced economies.

“This is a deep recession. It is a recession that involves solvency issues and unemployment going up substantially and these leave scars,” Ms Gopinath said.

__________________________

Emerging economies are forecast to perform better as a whole, but that is boosted significantly by China which is expected to have output in 2021 that is just 1.4 per cent lower than the IMF forecast six months ago.

If extensive lockdowns have to be extended beyond the second quarter of the year and Covid-19 returns in a milder outbreak in 2021, the overall economic hit would be twice as large, the IMF estimated.

Although the lockdowns are generating large economic contractions across the world, Ms Gopinath said they were necessary to get the pandemic under control. “There is no trade-off between saving lives and saving livelihoods,” she said.

The IMF’s economic forecasts for 2020 are not as pessimistic as many private sector forecasts. They assume that the lockdowns will result in an 8 per cent loss of working days which will be concentrated in the second quarter for most countries but in the first quarter for China.

Even with these moderate assumptions, global economic performance will be hit hard, the IMF said. It forecast that world output would decline by 3 per cent in 2020, 6.3 percentage points down from the growth forecast of 3.3 per cent that the IMF expected as recently as late January.

In 2009, the worst year of the financial crisis, global output dipped 0.1 per cent. The IMF considers any growth rate below 2.5 per cent to be a global recession because, 90 per cent of the time, global growth exceeds that rate.

Given the large fall in output, unemployment is expected to rise sharply even though many countries have adopted job retention programmes to keep employees attached to their places of work. As a result, incomes per person are expected to fall in nine in 10 of the IMF’s 189 member countries.

In the US, unemployment is expected to rise from 3.7 per cent in 2019 to 10.4 per cent this year and only dip to 9.1 per cent in 2021. There is likely to be a smaller rise in the eurozone from 7.6 per cent last year to 10.4 per cent this year and 8.9 per cent in 2021.

__________________________

Almost all other countries should plan for output next year to be about 5 per cent lower than thought likely in October 2019, the IMF said — a forecast that reflects significant bankruptcies and lay-offs. This growth performance will result in much weaker public finances as countries seek to limit the damage from Covid-19.

The IMF praised the efforts countries have taken individually to mitigate the pain and provide insurance for companies at the sharp end of the crisis. It said countries were right to lock down their populations to limit the spread of the virus and forecast that those such as Sweden that have followed alternative and looser policies would face just as deep recessions.

She added that the fiscal insurance provided by governments and extraordinary actions by central banks to keep financial markets functioning smoothly “will go a long way toward ensuring that the global economy regains its footing after the pandemic fades, workplaces and schools reopen, job creation picks up, and consumers return to public places”.

But she warned that many emerging economies did not have the resources either to provide adequate health services for their populations or to limit the economic damage. With many confronting simultaneous health, economic and financial crises, they “will need help from advanced economy bilateral creditors and international financial institutions” over the months ahead, she said.

Featured Image: Photo Credits: A closed café in Vienna, Austria. Businesses around the world have shut their doors © Leonhard Foeger/Reuters